IDEAS WORTH SHARING

Like what you're reading? Sign up for our Shared iDiz email list

to get new ideas delivered to your inbox.

Email Marketing – The Overwhelmed Marketer’s Guide (OMG!)

If marketing is part of your job, it’s almost a guarantee that you’re working with some kind of email marketing software. There’s also a good chance that someone other than yourself decided which platform to use, and at best you received a crash course in how it works. Let’s try to fix that. MailChimp, Constant…

In Case You Missed It – 4.17.24

Emotionally-intelligent email. The value of negative feedback. Blue-collar Gen-Z. Free Fin-Ed content. How to describe your job, and some friendly advice about your eX. Here’s what we noticed, in case you missed it: Emotional Intelligence… in Email? You know how you just delete some promotional emails without even reading them? I recently got an email…

It’s hard not to get caught up in a buzz that surrounds you.

The 2024 total solar eclipse happens Monday, and my hometown happens to be in the right place to see it all. It’s a big deal around here. Supposedly a “once-in-a-lifetime” experience* that we’ve been hearing about for the last few months now. Since this week was my turn to write a post for Shared iDiz,…

CU Numbers Need Marketing Love, Too

Quick, what’s your CU’s current Net Worth/Total Assets ratio? How about Total Loans/Total Shares? What percentage of your members are borrowers? How do these compare to other CUs like yours? Where do you even find these numbers? Now go deeper… WHY are these numbers what they are? Where does your CEO want them to go?…

How do you get new members to Google you?

Note: this post isn’t going to be about the “secrets” of SEO (although that probably would make a good topic for another post.) We aren’t going to spend time talking about keywords, inside and outside links, etc. It also isn’t going to be a post about what might be wrong with your website. This post…

In Case You Missed It – 3.20.24

We’re here with some FRESH takes from this week’s marketing conference! It literally just ended! We have insights about Financial education, marketing with data, using AI, setting a good marketing pace, junk fees and a surprisingly large fruit. Here’s what we noticed, in case you missed it: Junk fees are no joke The Biden administration…

3 big money questions from a new father

2024 has already been a crazy year, or maybe that’s just because I’ve spent most of it as a brand-new, first-time-ever Dad. Yes, parenthood is wonderful, watching my daughter grow and change is breathtaking, and I really, REALLY miss getting a full night of sleep. But this article isn’t about that. Instead of talking about…

Turn your staff into an Idea Factory.

Your credit union’s biggest assets are not on the books, but in the heads of the people who work there. Their experience has given them very specific insights, that when combined with some creative thinking become invaluable to your credit union’s future. So how do you turn those assets into something tangible? Turn your staff…

In Case You Missed It – 2.21.24

FAFSA fumbles, understanding the unbanked, paying for priority privilege, pricy pet ownership, astonishing AI advancements, and auto prices are almost normal. No one has time to catch all the news, so here’s what we’ve seen lately, in case you missed it: FAFSA frustrations flummox families For millions of college-bound students, filling out the FAFSA is…

Will it blend? The only CU fintech question that matters.

Quick, go search for something on your site. Now check online banking. Try opening an account. Set an appointment. Pay a bill. Ask the chatbot a question. Now apply for a loan. Take a look at the last few emails you got from your credit union. Do these systems all look and feel and function…

Move with the future or get left behind

My job has had a learning curve since Day 1, and I hope it continues. Because I’d rather move with the future than get left behind. It has been a powerful evolution I’ve been a graphic designer for over 40 years. My profession has transformed from markers, drafting tables and T-squares all the way up…

In Case You Missed It – 1.24.24

Boomers and booms, brands that x-ed out, a different type of Visa, and why you might be able to afford your very own influencer after all. Oh, and a tiny bit of bragging on our part. Here’s what we’ve seen lately, in case you missed it: Congrats, it’s a bouncing baby website! We don’t usually…

Solving the CU marketing “now what?” problem

“Now that we have this spiffy new software/system/service/device, our troubles are over! With the click of a mouse, I’m a one-person data-driven automated digital marketing powerhouse. Let’s make it rain, baby!” Click… “Upload Content?” Now what? Sound familiar? This is what I call the “now what” problem. We all know that digital transformation, digital marketing,…

Four ways CU marketers can kick-start 2024

The holidays are finally behind us, and so it’s time for credit union marketers to relax and settle right back into that comfortable post-holiday routine, right? Well… sort of. Here’s how to kick off the new year in style – and make sure you get a head start on blowing those 2024 project goals out…

In Case You Missed It (v36)

We’re putting the personal in personal loans. We’re looking into the financial future. We’ve got a possible DLT credit union, the straight dope about Tech and all the stats on 2023. While you’re home for the holidays, we’re… also home for the holidays. Here’s what we’ve noticed, in case you missed it: The American Zeitgeist…

24 Tips for Monster Results in 2024 (Part 2)

The holidays are incredibly close, and many of us are finding out we just don’t have enough time! Me included, but I made you a promise last week and I plan to keep it. So, amidst the flurry of activity that everyone is dealing with this week, I bring you the second half of iDiz,…

24 Tips for Monster Results in 2024 (Part 1)

The holidays are almost upon us and if you’re like me, you don’t have time to write – I mean, uh, READ a long think-piece article today. You just want to work on your end-of-year projects between intense online gift-shopping sessions. Or maybe the other way around. Well worry not! I’m here to provide you…

5 short, sweet ways to avoid CommitteeThink

The rationale for allowing committees to make big decisions sounds good – a small group of stakeholders with diverse backgrounds combine their experiences to solve a problem as a team, efficiently and quickly, in order to benefit the most people. So why doesn’t it seem to work that way? Why do some people see committees…

Real SEO for credit union websites starts with real people

Search Engine Optimization (SEO) is one of the most mysterious and misunderstood terms in the world of credit union websites. The standard “SEO tactics” that might work for sites selling shoes or smoothie recipes (stuff like excessive repetition, rephrasing, padding, keyword stuffing, title and meta tag blather, even more repetition, etc.) will probably just annoy…

Help us pick the biggest turkey

Hey, it’s a holiday week, so we decided to focus on the one thing that everyone seems to be worried about. How big of a turkey do you really need, and which of these are the biggest? Leave a comment to vote on your favorite! Is over-optimized SEO the biggest turkey? There’s something ironic about…

How to make your credit union’s Board of Directors cool

We’ve seen a lot of conversation in the past few years about the member aging problem and its impact on the future of the credit union movement. Yes, it’s undeniably an obstacle, but more than a few credit unions could benefit from examining themselves, particularly the Board of Directors, along with their membership. To put…

Why are our Board Members so Old?

Now that I’m on two Boards, I finally understand why there is so much gray hair on so many Board Member’s heads. They’re old. Like me. Not that gray hair is a negative. Because of my Dad’s mostly shiny dome, I’m just happy to have some hair up there, regardless of color. And there are…

Candid Conference Conversations

In the last month, I’ve been to two state credit union league conferences (the Virginia CU League‘s Growth Conference, and the Indiana CU League‘s Convention right here in Indianapolis). Wondering what’s on the minds of CU leaders right now? Fresh from the schmooze-a-thons, here’s a quick recap of some of the problems and solutions we…

In Case You Missed It – 10.25.23

There are credit union monsters running amok! Monstrous mortgage payments, brainless budgeting, dreadful data sharing, hairy hacks and scary scams. For all things creepy, kooky, mysterious and spooky, here’s what we noticed, in case you missed it: We’re Haunting the ICUL convention this week! Stop by our booth at the Indiana Credit Union League’s Annual…

The creepy side of web-crawling critters

‘Tis the season to be spooky, but don’t worry, this article doesn’t contain any actual spiders. Sorry to any arachnophile readers that got their hopes up. Big data is a monumental and plentiful resource to be found among the mountains of the Internet, and there’s plenty of gold in them there hills if you’ve got…

How to break out of a loan rut

Deposits may be hot right now, but loans are still the primary income generators, not to mention membership and asset grow-ers, for credit unions. Plus, loans are a chance to be a part of your members’ significant life events. So loans are still worth talking about. Unfortunately, credit unions have mostly been marketing the same…

How credit unions fit into the digital marketplace

Most credit unions have a heartwarming story about putting cash into the communal cigar box. That mental image is great, and it resonates with people who want to be community-focused. But how many people under the age of 35 remember the last time they paid for something with cash? We’re living in a world where finance…

In Case You Missed It (v34)

The power of local, how to use AI, the state of the Metaverse, getting samples of space rocks, fluctuating gravity and most unbelievable of all, annual reports can actually be interesting. Here’s what we noticed, in case you missed it: The extraordinary advantage of local In this article on the value of local institutions (financial…

Why credit union websites must be flexy and stretchy

When it’s time to build a new website for your credit union, what are you looking for? The longest list of features? An all-in-one, all-singing, all-dancing set of solutions to all your problems forever? Set it and forget it? Write a check and walk away? Or are you looking for a long-term relationship, a basis…

Why you need fewer members who look like me

The median age in the US is 38.5. The average age of a credit union member is 53. That’s already a big gap. But when you realize that 68% of their “most loyal” CU members are older than 65, suddenly that age gap feels even bigger. (No wonder so many credit unions are beginning to…

3 steps to change what people say about your CU

We know credit unions to be helpful, community-oriented and compassionate. We know they keep their members’ financial interests close to their hearts. But what do people really say about your CU? A lot of people (and I mean A LOT) have largely experienced financial services as punishment, as trauma. And they feel this way for the…

In Case You Missed It (v33)

In this edition, we take a look at showing off your real values, the way real-world costs are rising, some big moves from NCUA, a fancier ChatGPT, the current state of remote work, and more. Here’s what we noticed, in case you missed it. Lip service vs. real values Chip Filson’s “Just a Member” blog…

Five ways you’re losing deposits

After years in the basement, loan and deposit rates have been rising for a while, and at many credit unions, the deposit pendulum has swung from “Yikes! Deposits are spiking! We need to make loans!” to “Eek, we need deposits!” again. To help you tune up your deposit-fu, here are five ways you might be…

How to decide when to stop or push ahead

Marketing is an inexact process that sometimes takes a long time to pay dividends. Which might be why so many CFOs aren’t sure it’s worth the cost. Numbers People usually prefer to track a quick return on a specific investment, with digits they can show on a spreadsheet. But marketing isn’t accounting. That’s not to…

How to get started with Google Ads

Google offers you some excellent tools for tracking your site traffic and bidding on keywords. But let’s be honest, these interfaces aren’t the most user-friendly. In fact, at first glance they can be overwhelming and incomprehensible. The good news is you don’t have to be a tech guru to get started. Trust me, I’ve helped…

In Case You Missed It (v32)

BIG NEWS in the credit union world! Plus, 4-day work weeks, a call for transparency, Student Loan confusion, Apple Pay Later, and the Erie Canal. We’ve got something to say about all of these, and more. Here’s what we noticed, in case you missed it: Remember the 4-day work week? Surprise, surprise, it seems like…

Fixing the Top Five Accessibility Mistakes on Social Media

Sure, your website has great Accessibility, and you check up on it regularly to keep your site up to snuff. But what about the rest of your online presence? The bad news is, a lot of credit unions aren’t paying attention to Accessibility on Social Media, and routinely post content that a significant portion of…

Making content to attract younger members

Whenever the question of how to reach new, young members comes up, you’ll see recommendations like, “Make relevant, valuable and authentic content that displays your values,” and you have to wonder what the writer thinks it actually means. Now, this is actually good advice, but it can feel incredibly generic. I know this because I’m…

Enduring brands: What we can learn from Barbie

Get ready to see bubblegum pink everywhere you look this Summer! Margot Robbie is starring in a new live action Barbie movie, and Mattel has already signed licensing deals with over 100 brands. Not only can you dress like her, but you can also dress your dog to match (courtesy of Gap.) You can wear…

In Case You Missed It (v31)

What do rising interest rates have to do with Marketing? Is Pride only a June thing? Are you helping your members with student loans? Is getting advice from social media ever a good idea? Oh, and we hired a cat. Here’s what we noticed, in case you missed it: Welcoming the newest iDiz staff member!…

“Meatspace” is a CU superpower

Over the last few months, I’ve been to several in-person events, both professionally and personally. There really is nothing like being in real live “meatspace” with other real live humans when you want to connect, learn, innovate, and just plain have fun. Of course, you can also form real connections and have real, human-to-human experiences…

Is AI a good fit for credit union marketing?

AI (and AI marketing) is the brand-spanking-new tool that everyone seems to be excited about. If the internet is to be believed, it’s either a miraculous new tool that will save corporations BIG $$$, the end of artistic integrity and creativity as we know it, or both. But that’s kind of par for the course…

In Case You Missed It (v30)

CU numbers, a social media post idea, Gmail tricks, EDDM options, ancient tweezers, and who knew pickleball was so noisy? Here’s what we noticed, in case you missed it: New Age Direct Mail Sure, email, websites, social media, video, and all the rest are getting most of the attention these days, but good old direct…

CU Conference Shout-Outs

The “sixth principle” of credit unions is cooperation among cooperatives. And we feel a similar spirit should apply to those of us who serve the credit union movement. Here are just a few quick shout-outs to just a few of the innovative companies and CUSOs we’ve seen at NACUSO in Las Vegas in April, and…

Nurture young leaders to get more young credit union members

One of the most common long-term strategic challenges facing credit unions is the member aging monster. It’s a topic we’ve covered quite a bit right here in this very blog. Of course, there’s no one magic bullet for attracting and retaining younger members, but there are a lot of possible ways to give younger members…

In Case You Missed It (v29)

Misinformation and bots are everywhere, but at least there’s one baseball team with a lot of heart. Should you hop on the AI train, or wait until it’s a smoother ride? Who actually gets the tip when you order out? Here’s what we noticed, in case you missed it: Join the fight against misinformation Students…

3 superpowers of the Friendly Neighborhood Credit Union

When you think of ‘credit unions’, you might not immediately think of ‘superheroes.’ It might be difficult to imagine a superhero that would convincingly represent something like a credit union. People tend to be interested in superheroes that defeat supervillains and repel alien invasions, not ones that save people from high interest rates. But why…

Why are you hiding your true talents?

You know you are pretty amazing at some things. But you also know you are not amazing at every thing. And when you try to do everything, not all of it matches the quality of the things you are amazing at. Rest assured that you aren’t the only one like that. We all have our…

Strategic inspiration to help credit unions mix things up

Have you heard the saying about doing the same thing over and over and expecting different results? There’s a lot of power in good branding, authentic messaging and a creative loan campaign, but sometimes you should be looking elsewhere for inspiration. You might be surprised at how many fresh new ideas you can find when…

The big value in small credit unions

Here’s my bold prediction for the near future: small and de novo (new) credit unions will play a key part in revitalizing and re-energizing the entire credit union movement. Small credit unions (or call them “boutique” or “specialty” credit unions if you prefer) obviously have tremendous value to their members. But we’re only just beginning…

In Case You Missed It – NACUSO 2023

CUSOs are becoming more and more important to the credit union industry because they focus on solving specific problems. Which is basically what iDiz does. So we headed to Las Vegas for the 2023 NACUSO Network (why does every conference end up in Vegas, anyway?), and here’s what we think you might be interested in,…

3 ways to earn your members’ trust

There’s an old saying, “May you live in interesting times,” which supposedly refers back to an old curse. If you’ve not heard of it before, the gist is that it’s better to live in a “boring” time of peace and prosperity instead of an “interesting” time of conflict and change. And when it comes to…

In Case You Missed It (v28)

Step right up ladies and gentlemen, CUs of all sizes! We’ve got all sorts of wacky and wonderful things here today! For starters there’s an honest-to-goodness brand-new credit union getting started. The CU-world-famous Chip Filson gives his take on recent bank failures. Is artificial intelligence your new CEO? Can you get your paycheck before it’s…

New CU tech needs Marketing love, too

Woohoo! Your shiny brand-new website, online banking, mobile banking app, P2P payments platform, fribbert cromulator, or all the above is ready to rock! All your need to do is shut down the old one, flip a few switches here and there, and your members will love it! They’ll flock to download the apps, and no…

Work with me here.

A few years ago I got involved with a local non-profit, because they pulled together and did something positive and real for the community, instead of just talking about it. They bought land in midtown Indy and built a park – complete with a playground, picnic shelter, and baseball field. It’s not a huge park,…

Is AI going to steal my job?

According to the internet, ChatGPT is the newest hot-topic artificial intelligence that’s apparently going to steal my job and take over the world! ARGH! I wanted to know more about this scourge upon humanity, so I turned to every millennial’s secret work weapon: Looking it up on Google. Despite the doomsayers, ChatGPT is just a…

In Case You Missed It (v27)

What do Super Bowl ads have to do with 40K menus? Does it matter what you do on LinkedIn? Looking for generational FinEd content? You want it, we’ve got it. Here’s what we noticed, in case you missed it. Six things to stop doing on LinkedIn This is a wonderfully direct discussion of some of…

Why love needs CU marketing love, too.

When you think about it, credit unions and the whole credit union movement are pure love in action. I’m serious. Sure, the eight cooperative principles use fancier language, but when you get down to it, these core principles of the credit union movement are all just practical ways humans make the world a better place…

How to hire marketers that get-stuff-done

You aren’t the only one having problems finding people with the right skills to fill open positions. Especially when you are trying to hire a marketing person. Which makes it even more frustrating when, for every new hire you finally land, someone else decides to leave. It feels like a never-ending battle to get-positions-filled in…

3 ways to get BIG results from your tiny social media budget

It seems like budget is the Achilles’ heel of social media managers, regardless of industry. In my experience, this is equally true at credit unions. The reality is that your social media budget has to compete with the rest of your marketing goals, and might get ignored as a result. The good news is that…

Cruft check: fast, easy credit union website cleanup

Hey, I get it; housekeeping is hard. But it’s still an important part of keeping your credit union’s website running smoothly. Every so often, it’s worth taking a few minutes to clean up link rot, scrub that scruffy, crusty old content, and throw out last year’s leftover rates. Here’s our easy, fun checklist to get…

In case you missed it (v26)

Want to see how Gen Z-ers become CMOs? Or the update on Open Banking Standard? What about EV loans that aren’t just for cars, how to start your second career in PR, or how CU’s can be a financial side-piece? You want it, we’ve got it. Here’s what we noticed, in case you missed it.…

5 ways to get better social media results next year

We all know the way social media goes. In January you pull out your brand new social media strategy, you know, the one you were so excited to implement. You’re certain that this is the year… Then it’s suddenly April, and things have gotten so busy. As the year goes on, you tend to fall back…

In case you missed it (v25)

What in the world is a “Fractional CMO?” Are you following the Sixth Principle? Do we all need to get back to the office? Is it 1969 again? Everything from mapping boneyards to unusual job descriptions, here’s what we noticed, in case you missed it: The “Fractional CMO” Search Story There’s an interesting turn of…

Five things CU marketers can get done before 2023

2023 is right around the corner! Everyone’s putting down their hot chocolate and getting out of the holiday mood, and so it’s time for credit union marketers to relax a bit, right? Well… sort of. With just a little time and effort before we hit January whirlwind, you can get a fresh start on 2023,…

Have you thanked your website lately?

Right around Thanksgiving there’s a lot of talk about what people are thankful for. The old standbys like Love, Family and Good Fortune are all well and good, but there’s something that a lot of credit union marketers might have forgotten to show their appreciation for. What I mean is, your website does a lot…

You deserve a promotion, not more work.

Marketers at credit unions have always been asked to handle a lot of different things at once. Sometimes they’ve been asked to do more than one job. It kind of comes with the territory. Especially at smaller CUs. But that doesn’t make it a good idea. To keep piling on responsibilities, regardless of someone’s strengths,…

In case you missed it (v24)

This week, we’re pondering whether “unbanked” is out, feeling wary about Twitter, wondering why interchange legislation keeps coming back, finding tranquility, riding golf carts, and going green. Here’s what we noticed, in case you missed it: Time to ditch the whole “unbanked” and “underbanked” idea? Yes. This article on Financial Brand lays out the details…

Five ways credit unions can get the most out of Google Analytics

Any way you slice it, Google Analytics is a huge, confusing beast. The price ($0.00) is certainly right, and it’s an amazing resource, but Analytics can also be pretty bewildering, with lots of dead ends, rabbit holes, and red herrings galore. Plus, all the advice you find online is oriented toward websites selling shoes, games,…

5 tips to make video content your members will vibe with

Being in the marketing department means you know how to do video content, right? I mean, those kids on TikTok do it, so how hard can it be? Well, it’s true that it’s easier than ever to make content. But having access doesn’t necessarily mean it’s easy. Those TikTok content creators? They make these little…

In case you missed it (v23)

This installment of ICYMI is staying mobile, looking into the future, heating up, assessing risks and changing the world. Oh, and a little birdwatching along the way. Here’s what we noticed, in case you missed it: Mobile branches are the future I’ve been a big fan of mobile branches for a long time. I was…

Five ways you’re scaring members away

Gather ‘round the campfire folks, pour your favorite pumpkin-flavored beverage, and get ready for five spine-tingling cautionary tales of ways credit unions might be making members go “EEK!” and run away. Do you have what it takes to face the horrors ahead? Come closer, closer, and hear our tales of dread… The Website of Fright…

What good is a marketing budget that never changes?

It’s budget season once again. Time to dust off last year’s marketing budget, tweak the product promotions to match what lending wants to focus on this year, push the numbers as much as you think you can get away with, turn it in and hope that it doesn’t get trimmed too far back. Sound about…

In Case You Missed It (v22)

Calling out crypto clumsiness. An anxiety-inducing accounting of ants. Necessarily nuanced nudging. A realistic range of representation. The sale and safeguarding of Stonehenge. Vader’s voice virtualized. Here’s what we noticed, in case you missed it: Calling out the elephants in the crypto room… Even for the most dedicated fan of cryptocurrencies, there are some enormous…

Let’s get unapologetically, radically transparent

No, I don’t mean transparent as in “invisible” or “see-through,” and I certainly don’t mean “difficult-to-find.” The word transparency could refer to a lot of things inside a credit union, but for our purposes we just have to ask one question: Do people know how a credit union works? We know that people see “credit…

Five tips for credit union deposit marketing

Things are, well, pretty wacky out there in the US and world economy. Loan growth has been strong this year, surprisingly strong, and at many credit unions loans are starting to outgrow deposits for the first time in a few years. And so now, with inflation, general uncertainty, and rising rates on people’s minds, some credit unions are…

Is it time for Credit Unions to go Virtual?

The labor market has had 20 consecutive months of sustained job growth. The unemployment rate has been hovering around a 50-year low. It’s really no wonder that employers are having to boost hourly and salaried pay just to compete for workers. Credit unions are in the same boat. It’s harder-than-ever to find new, qualified personnel.…

In Case You Missed It (v21)

We’ve got student loans and a new breed of scam. Millions of disease-fighting mosquitoes. A cost-of-living comparison, the rise of mobile banking and a whole lot of real-life experience. What’s on your bingo card? Here’s what we noticed, in case you missed it: The great Student Loan debate By now you probably have heard that…

We need Financial Education for those not-so-happy times

When members come to your credit union for a mortgage or a car loan, it often feels amazing. Helping someone start a retirement account feels smart and safe. But there are a lot of life events that don’t give us those warm-fuzzies. If you spend any time on the r/personalfinance subreddit, you’ll see a lot…

What credit unions can do when the aliens land

Let’s face it – “disaster planning” is kind of, well, depressing. The last few decades have been a little too full of “once in a lifetime” events. So how can a CU marketer stay flexible, stay loose, and plan for the unplanned? Aliens, that’s how. No, seriously. Aliens. Bear with me — there are some…

Do you have website blindness?

Is your website actually usable, or are you just used to it? If you’re working with your website frequently or even daily, you might feel like your website is truly, actually user-friendly. But the problem is, you’re too close to it. You might have website blindness. It’s easy for you to navigate a website when…

In Case You Missed It (v20)

We’ve got free student loan financial education. Checking account sign-on bribes are a bust. Starbucks supports Deaf-REACH. Webb and Hubble compare telescope sizes. Big brands are creating RBG IPs. And that’s not all. Here’s what we noticed, in case you missed it: Student Loan Sense videos launched, free for CUs! We’re incredibly proud of this…

How credit unions can be much more than loan retailers

Lots of people make bad decisions about their money simply because they were never taught how to make good ones. Which often gets blamed on their parents, since 83% of US adults say that parents are the most responsible for teaching their kids about finances. Yet 40% of parents claim they talk to their kids…

Compliance needs marketing love, too

Wait, isn’t that weird? Aren’t Compliance Officers the credit union marketing buzzkills? I mean, every time we come up with a brilliant marketing idea, those mean ol’ meanies want to cover it in fine print, or just take all the fun out of it. Aren’t we natural enemies? Well, no. Here’s why Compliance and Marketing…

3 questions to help you maximize your social media marketing

A lot of people are treating social media marketing exactly like every other type of marketing. They think that if they put an ad on a social media platform, people will just show up. “If you build it, they will come” and all that. But you’re not Kevin Costner, and this ain’t your granny’s marketing.…

In Case You Missed It (Vol 19)

GA4 deadline, crypto crisis, risk management, e-bike deliveries, Mars samples, Nerf rockets, CU opportunities. We didn’t start the fire…. Here’s what we noticed, in case you missed it: NCUA Streamlining Underserved Area application process One of the best solutions for solving the “banking desert” problem is credit unions that expand their fields of membership with…

Make your CU website pay: getting to know your members

Your credit union’s website isn’t just a glowing brochure; it should be the hub of your marketing, an engine for growth, and a no-brainer investment, that makes a big difference in the bottom line. But how do you actually make that happen? This is the first post in a “Make your CU website pay” series…

Huge credit union opportunities in the news

Here’s a recap of a few recent news stories that also set off that little light in my brain labeled “You know, credit unions have opportunities to really think big here”. Closing the Black homeownership gap Ponder a statistic from this article from SWBC: “In 2021, Black homeownership rates were at 44%, while 74% of…

Don’t be like an airline

You might not think that an airline has a lot in common with a credit union. But when you think about it, people come to both airlines and CUs because they want to do something else. No one I know rides commercial airlines or takes out loans because they enjoy doing those things. Both airlines…

In Case You Missed It (Vol 18)

Get out your Buzzword Bingo cards! This week we’ve got “green”, “FinEd”, “pizza”, “crypto”, “carbon”, “Lego”, “Pride”, and, uh, “glue”. Here’s what we’ve noticed, in case you missed it: Considering Green Loans? The time could be now Reuters recently reported the President will announce new executive actions to increase the production of solar panels and…

Mission is your credit union’s not-so-secret weapon

“Why are you here?” It’s a small question. And it’s a big question, too – the biggest, really. The answer, and more importantly the truth of that answer, will determine whether a credit union thrives and survives. “No, why are you really here?” We’re not talking about a slogan, a tag line, or the boring,…

Legends don’t just happen, they’re built.

Despite its name, New College (part of Oxford University) isn’t exactly new, having been built in the late 1300s. And with that kind of history, it isn’t surprising that even some of its buildings have their own stories and legends. Take the New College dining hall, known for the enormous oak beams that span across…

Your Granny’s on TikTok. Oh my!

When TikTok got started, it was generally a kid’s platform. It was the home of lip-syncing, dancing, and general antics. As a result, most of its user base was in the under 20 demographic. Fast forward to 2022, and things have changed. Pew Research Center’s survey of adults from 2012-to 2021 showed that 40% of the…

In Case You Missed It (Vol 17)

True facts you won’t believe. Great ideas and voltage drops. Provocative lip balms, why we need small CUs, and a disgusting political party quiz. Here are the items that caught our eye, in case you missed it: Powering through the “voltage drop” when you have a great idea I subscribe to Behavioral Scientist, and you…

A second look at CU science fiction

Many years ago we wrote a post called “Credit Union Science Fiction” as an attempt at looking into the future. It was a fun, funky mental exercise that let us flex those precognitive muscles a little bit. After all, making predictions and planning for the future is an important part of every marketing strategy. We…

What GA4 means to CUs

If you deal with your credit union’s website Analytics, you’ve probably heard some buzz about Google Analytics 4, known as “GA4” by all the cool kids. GA4 is certainly an improvement over the older versions of Google Analytics in many ways, but it is very different. Here are some of the things credit unions need…

Finally, a little clarity on credit union website Accessibility and ADA compliance

The US Department of Justice (DOJ) recently released their guidance on how the Americans with Disabilities Act (ADA) applies to websites. Despite thousands of lawsuits from ADA trolls, the issue muddled along for years without “official” clarification on the actual rules of the road. This article from NAFCU’s Compliance Blog is a great summary of…

In Case You Missed It (Vol 16)

Why you should look into becoming a Juntos Avanzamos CU. How Fortnite and an author are raising millions. How you really need to use that NCUA logo, and why I now want to earn my black belt in Verbal Aikido. Here are the items that caught our eye, in case you missed it: Does your…

Five Ways You’re Losing Car Loans

I don’t need a crystal ball to predict that your credit union needs to make more loans. And of course that means good ol’ auto loans, mostly used car loans. Free of charge, we’ll share five things you’re probably doing wrong with your car loan products, your member experience, and your auto loan marketing (just…

Hey CUs, young people need your help

I’ve written at length about how credit unions can get noticed by Millennials. But sometimes it feels like people forget how time just keeps passing us by. Not to make anyone feel old, but as of 2022 millennials are now between the ages of 26 and 41. This means the vast majority of college grads…

Monster Problem: How can I get more out of my Marketing Department?

Regardless of the credit union’s size, someone always seems to be asking this question. This is often because Marketing is too-often seen as an expense rather than an investment, and numbers people tend to worry about costs more than growth. But that doesn’t mean the question isn’t worth asking. So how do you get more…

In Case You Missed It (v15)

Young professionals aren’t the only ones job-hopping more often. Actual proof that marketing actually works. E-Z SEO and cookie-less analytics. Plus a brilliant name for a sperm collection company! Here are the items that caught our eye, in case you missed it: The non-stop job-hop bebop Young professionals are job-hopping at an ever-increasing rate. According…

CUDE training and my credit union adventure

I’m an avid motorcyclist, and like anything involving high level skill, part of the fun is constant improvement. Whether I’m riding the same old seven miles to the office, romping through the curvy roads in southern Indiana and Kentucky, or seeking out the most primitive dirt roads I can find, there’s something to learn from…

Student loans are crucial for making credit unions relevant to young people

Student loans continue to plague our youngest generations. This debt is keeping us from buying cars, buying houses, having kids, and generally moving on with our lives. Need proof? When the U.S. Department of Education offered to freeze student loan payments during the COVID-19 pandemic borrowers collectively agreed wholeheartedly. So much so that more than…

Fun facts for TWOsday

Today is TWOsday, February 22nd 2022 (2-22-22) and that’s the most 2s we’ve had in a date since February 22nd, 1922. There’s only a handful of these dates every century, and two of them happened this month (2-2-22)! We wanted to take a moment to recognize today’s date, because chances are that none of us…

Five marketing automations credit unions should try

Marketing automation can help credit unions find members and improve loan growth. For example, automation can create and manage email campaigns, help you manage member feedback, or target content based on where members are in their personal needs. But how do you find out which tools work best? Do you need to jump right into…

In Case You Missed It (v14)

Why GA4 is worth learning about. What science can teach us about emotional intelligence. Plus plastic that is stronger than steel, and FREE resources! Here are the items that caught our eye, in case you missed it: How a CU can live up to its true purpose “Someone’s financial well-being is as much about how…

3 reasons why your CU should be promoting sustainability

For an unfortunate number of people, sustainability is just another buzzword. Like “Organic” or “Eco-Friendly,” it’s just a bit of hippie dippy hooey that businesses pay lip-service to for PR reasons. In other words, it’s just a Marketing thing. Well I think that attitude is not just sad, but frustrating. It’s outright bogus and not…

Why you should offer Loans for Oddballs

Loan season is right around the corner, i.e., your credit union’s bread and butter. So if you haven’t already started working on your spring and summer auto, boat, home equity and mortgage loan campaigns, then you better get in gear. If you can get excited about one more loan campaign, that is.* I mean, I…

Soft impacts and hard numbers

You’ve probably seen this quote from Maya Angelou: “I’ve learned that people will forget what you said, people will forget what you did, but people will never forget how you made them feel.” Maya Angelou It’s a simple, but powerful truth. And it’s why credit unions at their best pay careful attention to those “soft…

In case you missed it (v13)

Green loans and the potential harm of AI decisions. Faux holidays and the end of the 40-hour work week. Here are the items that caught our eye, in case you missed it: Not Just a Nerd Fight Timnit Gebru is an AI researcher delving into the issue of the harm AI can do to marginalized…

Core conversions need Marketing love, too

Technology moves fast, and credit unions need to move faster. Or at least keep up. If changing or upgrading your core processor is on the table, here’s why Marketing needs to be sitting at that table. Be there from the beginning No one embarks on a core conversion for fun. It’s a monster project, and…

Fresh, never frozen lessons from Wendy’s marketing

Wendy’s digital marketing team has always been impressively in-tune with what the internet likes. They’ve long since become well-known for roasting people on Twitter, and to top it off? They’re actually funny. More recently they’ve launched their “Super Wendy’s World” campaign to target gamers, and with the size of the industry it’s easy to see…

Wishing you a happy holiday with some festive cookie recipes!

We hope you and yours have a well-earned, relaxing holiday weekend, uninterrupted by Marketing Monsters and other stress. To celebrate, we’re sharing some of our favorite cookie recipes to help everyone get into the holiday spirit! Christmas Peanut Butter Cookies From Jon Cooper These cookies have the perfect blend of sweet and salty while also…

How to keep those winter Marketing Monsters from getting ABOMINABLE

During the winter months, it gets really easy to let things slide as you plan for warmer weather. Unfortunately, those Marketing Monsters aren’t waiting until spring comes to cause you problems. In fact, winter is usually when those problem monsters become Abominable. When I say Abominable, I mean big, hairy, and out of control. While…

In Case You Missed It (v12)

An overdue moon reunion, a VISA-less Amazon, a potentially huge new CU, why Bankthink is destroying credit unions, yet more overdraft news, and drones that look alive. Here’s what we’ve seen lately, in case you missed it: It’s been 50 years since we last visited the moon. Back in 1972, Apollo 17 launched from NASA’s…

Five Fun Winter Website Projects for CU Marketers

I’m a dedicated motorcyclist, so winters are the time when I catch up on all the home and garage projects I neglected in warmer weather. As it turns out, I’m out of moto-projects right now. My bikes are all running great, and I organized all my tools and spare parts last winter. So this winter…

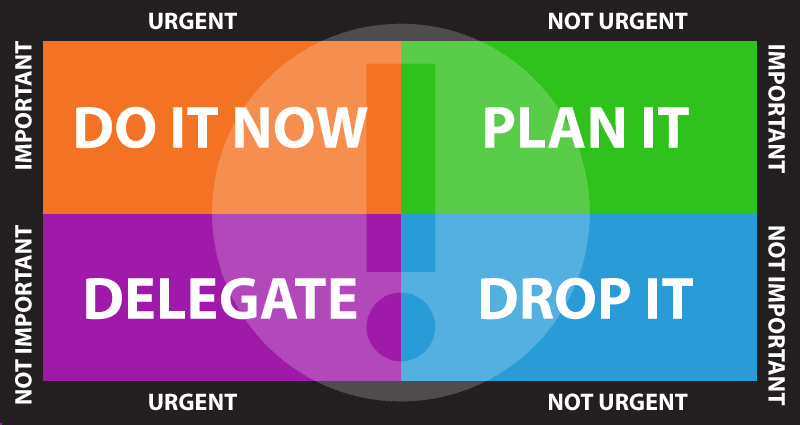

Quick wins CUs can get done NOW

There are times when you need a few quick wins. Whether it’s budget season, or there’s another review with your boss and you just need to get some results and look good. Maybe you still haven’t gotten that list of To-Dos done, much less hit all those goals! OMG! It’s okay. Don’t panic. Simply take…

Giving thanks and sharing some Monstrously Munchy Recipes

This week, instead of delivering another deep dive into a new marketing topic, we wanted to come up for air and just say: Thanks. Thank you for being you, for working so hard and for doing your best to make our world a better place. In celebration of the holiday weekend, we’ve included some of…

In case you missed it (v11)

How much time do you waste commuting to work? Did you have “The Money Talk” before you committed to your partner? Do you suffer from Electile Dysfunction? Here’s what we’ve seen lately, in case you missed it: Electile Dysfunction: what we can learn from a political ad done right No, that’s not a typo. It’s…

Why we need to help start more new credit unions

It seems that while we and everyone else in the credit union movement were busy growing existing credit unions, it slowly became incredibly difficult to start a new credit union. At the same time, it has also become easier and far more common for credit unions to disappear via mergers. The stats are staggering: over…

Why good credit union branding is never done

Just like people, every credit union wants to be well-known and popular. They want to portray an image or persona that everyone knows, understands, and likes. Kind of like my brother. When my brother was in high school, he always wanted to be like the “cool kids.” Because the “in-crowd” seemed to have all the…

Get face-to-face with the Financial Education Monster

This pesky pain-in-the-neck likes to sit in the periphery. The Financial Education monster lurks just out of view, a persistent reminder of a mostly unfulfilled promise you made to your members. And even worse, your members can see the scruffy, generic, little rascal, too. Here’s how to brush up the Financial Education Monster, give him…

Wrestling the Member Onboarding Monster

This slippery, sly critter is a regular Houdini. Without constant attention and communication, the Member Onboarding Monster slips overboard the instant your back is turned, taking hundreds of members with him. Here’s how to turn this beastie into your member retention bestie, and transform single-service and indirect members into lifelong super-fans: Automate onboarding This one’s…

Feeding the Social Media Content Beast

It’s always hungry, always screaming for more, MORE MORE! The Social Media Beast craves a constant stream of tasty snack-size content, and it’s insatiable. Here’s how harried credit union marketers can keep this ravenous critter happy while keeping their sanity. Repurpose, recycle, and repeat The first rule of content cookery is to make the most…

GoodiDiz Podcast: Drag Queens, Credit Unions, Inclusion, and Love with Dan Marquez

The GoodiDiz concept is simple. Credit unions do a lot of good in the world — and they’re also a strong and sustainable business model. So we’re exploring the good ideas, both inside and outside the CU world, that can do a lot of good while also being good business. In this episode, I’m talking…

In case you missed it (v10)

The secrets of top designers. What drives millennials and gen-z away. Some really ugly logos. Here’s what we’ve seen recently that you may have missed: Everything is made up (and 29 other designer secrets.) Be a sponge. Emotions matter. Embrace your harshest critics. Everything is made up: “Every language ever spoken…Olympic games…Smart phones…Pizza…Ice cream…Google! Everything…

GoodiDiz Podcast: Financial inclusion and de novo credit unions with Denise Wymore

The GoodiDiz concept is simple. Credit unions do a lot of good in the world — and they’re also a strong and sustainable business model. So we’re exploring the good ideas, both inside and outside the CU world, that can do a lot of good while also being good business. In this episode, I’m talking…

Learn to love your haters

I hate to be the bearer of bad news, but… not everyone is five stars, A++++, bonkers crazy in love with your credit union. No matter how awesome you are, not everyone will agree. But here’s the good news: that’s OK. Really. There’s a lot you can learn from the haters, the not-so-greaters, and the…

In case you missed it (Vol 9)

Mysterious FICO scores, a spam & hacker tools company on Facebook – which is building a new universe – and apparently millennials have attitudes. Go figure. Here’s what we’ve seen recently that you may have missed: FICO Fuss Why FICO Scores are up by Dinny Lechman, has some interesting news detailing why the average FICO…

The best websites are never done

Once your credit union’s spiffy, super-fresh new website goes live, you can raise a toast and cross website stuff off your to-do list for a few years, right? Not so fast. A new website is only fresh for a brief moment in time. The world, your members, and what they want and need are constantly…

In case you missed it (Vol 8)

ICYMI: CUs either merging or buying banks, transparency that builds trust, and ideas you need to borrow. Here’s what we’ve seen recently that you may have missed: According to the media, CUs are crazily merging… So far there have been 74 mergers of CUs in 2021, which if it continues at that pace will break…

To become a CEO, think like a CEO

For most of us there is a process to career success. First we need to establish our footing, then learn the ropes, demonstrate our talents, and gradually move up the corporate ladder until we reach the very top. After all, becoming CEO is the ultimate goal, isn’t it? But only so many people can make…

GoodiDiz: How to get good data to make good decisions

A conversation with Rich Jones on data integrity for credit unions of all sizes We’re kicking off a brand new series of video/audio podcasts with a bang, with our first guest, CU strategy superstar Rich Jones! The GoodiDiz concept is simple. Credit unions do a lot of good in the world — and they’re also…

Bracing yourself for CU budget season

All across the land, credit union marketers are polishing up their crystal balls, sharpening their pencils, and gearing up to face the most fearsome beast of all: next year. Following are a few tips for balancing strategy with resources to get the biggest bang for your members’ hard-earned bucks — and your time and energy.…

In case you missed it (Vol 7)

RTO Mortgages, UPLs, AIO for EVs, and the beginning of the end of NSF fees? ICYMI is our way of sharing “Did you see this?!” news and tidbits, just in case you missed it. (And yes, we do try to spell out the acronyms.) Branches still matter Alaska USA FCU’s new branch is in North…

In Case You Missed It (Vol 6)

Mergers are up. Good guys crashed a non-profit’s website. CUs that are actually serving the underserved and cutting back on NSF fees. ICYMI is our way of sharing the best of those “Did you see this?!” news and tidbits that we usually send to each other, and here’s what we’ve seen lately: A great start…

HR needs marketing and brand love, too.

Obviously your job as a Masterful Marketing Maven and Boffo Brand Boss is to bring in those new members and pump up those loan and deposit numbers. Staffing isn’t anywhere near your wheelhouse, so it’s best to leave all of that up to those Human Resources folks at the other end of the hall –…

In Case You Missed It (Vol 5)

ICYMI is our way of sharing the best of those “Did you see this?!” news and tidbits that we usually send to each other. If you like this kind of thing (or don’t), feel free to let us know or join the conversation. In the meantime, here’s what we’ve seen lately: CEOs are getting younger every year Cross a lemonade…

Boats Aren’t Motorcycles

As a marketer, you can slap an image of a car or a house on your ad for an auto loan or a home loan and most people will get it. But what if you want to offer loans for boats, RVs, ATVs and UTVs, electric bikes, snowmobiles or jet skis? And what do you…

CUSOs need marketing love, too

CUSOs (Credit Union Service Organizations) can be a fantastic way for credit unions and groups of credit unions to better serve members and nonmembers, generate income, collaborate with and serve other credit unions, and meet all sorts of needs. There’s an endless variety of CUSOs out there, and the number is growing, even as credit…

In Case You Missed It (Vol 4)

In Case You Missed It is our way of cutting down on those “Did you see this?!” emails that we kept sending each other. Instead, we’re sharing the best of these tidbits and insights with all of you. If you like this kind of thing (or don’t), feel free to let us know or join the conversation. In the meantime,…

Word-of-mouth referrals are the best marketing tool.

My dad wasn’t exactly all that handy in the area of home projects when I was younger. In his defense, though, he had no internet, YouTube, or Google to lean on back then. So, when he started a home project, there was a high degree of probability that he’d need help to finish the job…

Data Cooperative: Big Crazy or Not-So-Crazy Idea for CUs?

While many credit union boards and C-Level staff still appear stuck in traditional ways of thinking about who they are and what they offer, at least a few CUs seem to be in an all-out sprint toward a new digital future. My only concern is that this particular race to the future is going to…

In Case You Missed It (Vol 3)

We recently decided to stop sending each other “Did you see this?!” emails, and start sharing them with all of you, just ICYMI. If you like this kind of thing (or don’t), feel free to let us know or join the conversation. In the meantime, here’s what we’ve seen lately: Want an honest, if inebriated, opinion of your…

CU mergers need marketing love, too

Even the smoothest credit union merger is a whirlwind of details. Of course, making sure the accounts transition smoothly is job #1, but merger partners also have to pay close attention to personnel, cultures, regulatory requirements and all the rest. No wonder it’s so easy to forget something very important – your members. Communicating with…

In Case You Missed It (Vol 2)

A couple of weeks ago we decided to stop sending each other “Did you see this?!” emails, and start sharing these opinions and reactions with all of you. If you like this kind of thing (or don’t), feel free to let us know or join the conversation. In the meantime, here’s what we’ve seen: Renters now pay less than homeowners; what does…

Indirect auto loans need CU marketing love, too

Indirect auto loans are a sticky issue at a lot of credit unions. Folks you might not ever see in person get their car loan, pay it off in a few years, and then leave without opening a checking account, a credit card, or even stopping by a branch to try your custom roasted coffee.…

Website accessibility and translation go hand-in-hand

For some people, website translation (and other forms of web accessibility) seem like more of a compliance issue than anything else. They only want to do what’s necessary to avoid any accusations or complications, and no more. Once done, the translations and other changes will likely sit there. They’ll be untouched by future updates, because…

ICYMI (In Case You Missed It)

We all have opinions. About a lot of things. And especially about things we see that may affect you, our friends and clients. So instead of simply filling up our co-workers’ inboxes with “did you see this?!” emails, we thought you might want to join in. So here is our inaugural post of ICYMI (In…

Easy wins to improve page speed and convert more customers

Many marketers and website managers have no idea how to make their website faster, even though they may be responsible for its content and general upkeep. That brand-spankin’ new website might have that fresh site smell now, but it only takes a few months of lackluster care to spoil your visitors’ website experience. In this…

Why clarity is King for marketing to English language learners

Many a Marketing 101 student in has heard the tales of the Chevy Nova and Colgate. In these stories, a lack of diversity or language research led to embarrassment and abysmal sales in Latin American markets. A great first lesson in international marketing, or marketing to English language learners, right? Well, it turns out that…

The Gig Economy and how credit unions can help

As a millennial it’s weird that I get to say this, but here it goes: the economy and the workforce don’t work the same way they used to. A significant portion of adults are now a part of the Gig Economy and we’re seeing a decline in full-time, salaried positions with benefits as we navigate…

Why should I care about social responsibility?

Every time you turn around it seems that another company is taking a stand on social issues, or using part of their profits to support charitable groups and causes. Doesn’t that divert attention away from making more money? After all, isn’t that the true purpose of capitalism? It’s all about the common good. Social responsibility is…

Credit Union CEOs need CMOs ASAP & PDQ

One of the great things about working with credit unions of every size all over the country is that they’re all so different. Every CU has its own interesting culture and unique way of doing things. And one of those very telling differences is the role of marketing in the organizational chart. What’s the title…

What your credit union needs to know about Facebook

If your credit union has been just kind of existing on Facebook, here's how to turn your page into a Facebook engagement phenomenon.

5 reasons to fix your “mostly sorta OK-ish” credit union website

If your credit union’s website is a real dumpster fire, then the reasons to upgrade ASAP and pronto are pretty obvious. But what if it’s just… a little lame? Sorta… meh. Just, you know, not awful, but not great. What’s your motivation if it’s not TOO painful? Here’s why now is exactly the right time…

Rebranding: why it’s all about your “why”

It’s human nature to name things to make them easier to understand. We name things in order to identify what they are, organize them into some sort of system, and describe them to others. And once named, that thing then becomes a bit more real to us; we start to feel ownership, more of a…

The car loan we didn’t get at our credit union

Deposits are climbing and credit unions need to make loans. Mortgages are in high demand, but you need consumer lending to stay in balance. And that means car loans. New, and (mostly) used car loans. So why are credit unions, even large CUs, still throwing away so many car loans? Here’s my real-world, real-life, 100%…

What young people actually want (part 2)

A few weeks ago I started asking the young people I know about the things they want from a financial institution. I received a flood of opinions and wrote up some of their main ideas, but now it’s time to get specific: Credit unions have an awareness problem, particularly with young people. Credit unions and…

Is your credit union trustworthy?

Building trust helps business. In fact, many consumers will overlook higher costs if they think they can trust you. With large tech companies’ identity theft and data breaches uncomfortably too common lately, faith in online business has taken a beating. Savvy credit unions should see this as an opportunity to stand out. By taking the…

It’s never too soon to think about your legacy.

In life, there seems to be an innate human desire to make a lasting impact. Sure, your ego wants to be remembered, but you also want to accomplish things that will truly help others in the future. It’s both selfish and unselfish. And that’s OK. Legacy thinking is one way to think longer term. While…

How small credit unions can start thinking big

Small credit unions have a special set of marketing and brand challenges. Budget and time limitations are pretty obvious, and keeping up with technology is always challenging. If you’re a one-person marketing department, or even a part-time marketer wearing a few other hats, here’s how to start thinking about your growth strategy, marketing, and brand…

What young people actually want (part 1)

If you don’t want to talk to young people, I get it. Their memes are confusing and their fashion choices can be scary. But you can’t grow younger if you aren’t really sure what these folks want. The good news is that I went out and talked to the youths for you, and they had…

If you’re targeting everyone, you’re targeting no one.

Of course, every marketer knows “target marketing” is a good idea. After all, it just makes sense; get the right message in front of the right people, and success will rain down. But when it’s time to build a creative brief and develop the message, people seem to get cold feet. “We’re targeting left-handed Moms…

Big Brand Updates: Fix or Fail?

Most brand updates happen for a reason. Something has changed that needs to be fixed for the brand to grow in the future. Recently, several major companies have updated their brands, and of course everyone had an opinion. Some were applauded, while others were panned. Some were a strong Fix, while others were a surprising…

Free product idea: Digital Life Accounts

Just handing over paper money is sooooo 2010, and it’s honestly just a little icky these days. Like most modern humanoids, I live a more digital life. But it’s a little like speaking multiple languages; everyone needs more than one payment method on hand in order to have the best odds of aligning with another…

5 Ways to Make Your Website Personalization less Creepy

Website personalization continues to be one of the hottest marketing trends because it can improve user experience and sales conversions. Most people appreciate when content is tailored. It’s quick, intuitive, and convenient. However, many consumers are also more privacy-aware and suspicious of marketers trying to collect their data. When personalization gets too intrusive, people start to…

Speaking the same language

Sam’s superpower is speaking Spanish, but I can’t say I have the same gift. Five years of German classes didn’t leave a lasting impression, and besides, every German I’ve ever met already speaks impeccable English. But his tale did remind me that even if the language is English, there are still a lot of ways…

Speaking Spanish is my superpower

You wouldn’t know it from my current curmudgeonly outlook, but I was not a particularly shy kid. To hear my family tell it, I could have held a conversation with a brick wall as long as it nodded in the right places. I had this deep-seated need to make friends and be liked. I wanted…

The Double Jesus Day

Long ago, and not so far away, I worked in a mental hospital. I was working my way through college, which should give you an idea of how long ago this was. It paid about the same as burger-flipping, but it was infinitely more interesting, and of course I learned a lot of people skills.…

Give a gift card. Save the world.

During the holiday season, life can get pretty hectic. Throw in an economic recession or pandemic, and you probably feel like you’re just surviving. Finding the right gift for the right person is exhausting, and this year it’s doubly easy to fall behind. So what are you supposed to do when you’re behind on holiday…

Good iDiz (v5): Security CU

Last month we realized everyone would appreciate hearing a little more good news, so we’re continuing our pleasant positivity publications with a look at the good people over at Security Credit Union! They’ve got community spirit AND holiday spirit! Security CU literally walks the walk These peppy pedestrians were recognized back in November for their…

Would YOU buy from you?

Online shopping has exploded this year, for obvious reasons. But because people have more time available, they are also doing a lot of online research, making sure they buy products from companies they like. They also apply that same process to other decisions – such as deciding where to get a loan, or determining which…

How to Fight Professional Burnout during a Pandemic

Burnout is one of the most debilitating disorders professionals can face. It’s a sneak attack on your mental health that slowly creeps up on you. It can strike anyone in the workplace and can be a challenging condition to treat. And adding the reality of a global pandemic only amplifies the damage. Know the signs.…

3 millennial misconceptions that I’m going to kill, right now

There are a lot of think pieces, blog posts and even news articles out there about millennials and how different we are. Some are more successful than others, but an unfortunate number of them are just plain wrong. I call these millennial misconceptions, mostly for the alliteration. But why do people seem to care about…

What do you mean by “the good guys?”

Who are “the good guys?” How do you know if someone is good? It might be even more difficult to be able to say that about a company. We know that people like to support companies and organizations that make them feel good. They want to know they’re doing the right then when they buy…

Good iDiz (v4): IHCU

In November we decided we’d had enough gloom & doom, so we started something new. Good iDiz is the way we keep our focus on well, good ideas. We’re on the lookout for people offering a helping hand. This week we’re highlighting the helpful folks at IH Credit Union! IH Credit Union extends a helping…

Is your sludge unintentional or intentional?

Sludge in an organization is anything that gets in the way. Sludge creates friction and frustration, slows things down, and makes it harder to get things done. As I’ve said before, the Sludge Monster is a dangerous beast infesting far too many credit unions. Since I’m something of a sludge scholar, I was very interested…

Will Robots Take My Job?

In the movies, robots are sometimes pictured as benevolent assistants to help humans in futuristic settings. After all, they tend to perform specific tasks faster and more accurately than their human counterparts. But will they take over everyone’s jobs? Carl Benedikt Frey and Michael A. Osborne published a report titled “The Future of Employment: How…

Data Digging Disappoints. Duh.

Billions of words and dollars have been spilled on the topic of Big Data and Marketing for credit unions and banks. But far too often, the quality of the offers, messaging and creative sent to those exquisitely preened, pruned, selected and targeted lists gets almost no attention. We see this in quite a few marketing…

Tell us WHY you exist

It is, at worst, an open secret that younger consumers like purpose-driven companies. Values-based organizations. Conscious Capitalism. You get the idea. People view companies more favorably when they have clear goals that are not just “make a profit.” This works particularly well with Millennials and Gen-Z, but it’s pretty strong across the board. But, what’s…

Good iDiz (v3): cPort CU

Last week, we started touting some of the folks we know have deep ties to their local community. This week we’re continuing the trend with another classy community-building credit union: cPort Credit Union! Got some positivity you’d like to share? Help us keep this newsletter going! Let us know about other CUs and organizations helping…

Social media content isn’t one-size-fits-all

Creating good social media content across different platforms can be difficult. It isn’t just about creating images in different sizes, or figuring out how to fit three paragraphs from Facebook into a single tweet. Not all social media platforms were created equally. For one thing, not all social media platforms have the same functionality. There…

Your silence speaks volumes.

Social media has created a unique space online where your presence says as much about you as your absence. In other words, your members pay attention to what you don’t say. Millennials and Gen-Z are more and more important with each passing year, and they care deeply about your values. What do you stand for…

Credit Union Website Analytics: Google Search Console

As I’ve said many times, Credit Union websites are weird. They don’t follow the same sorts of rules as other types of websites, so it can be tough to interpret your data. What’s normal or abnormal? What should your goals be, and where can you make a difference? Fortunately, we’ve built lots of credit union…

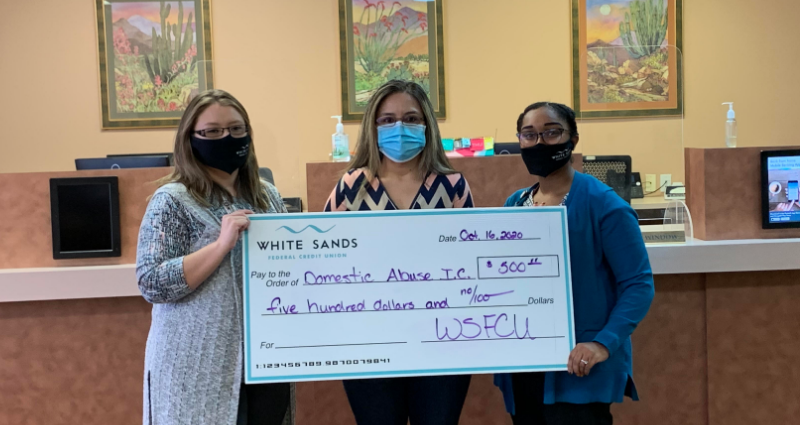

Good iDiz (v2): WSFCU

Last week we decided to start focusing on positivity. We’re started looking for examples of community building, charity, and things that generally put a smile on our faces. We hope you’ll help us keep it going. This week, we reached out to some folks we know have deep ties to their local communities. They told…

Good iDiz (v1): Alloya

We’re all about good ideas. However, the world isn’t going to be very normal this week, so we’re doing something different. This Shared iDiz is going to be all about positivity. We’re sharing good news and good vibes, and we hope you’ll help us keep it going. We reached out to our friends and clients…

2020 has been bonkers. Start next year right now.

We know. This year has been absolutely crazy, and you are done with it. All you want to do now is hide behind various screens all day and hope for it all to be over. But there’s still a couple of months to go this year. And things may not return to normal for a…

Why credit unions must kill off Microsoft Internet Explorer (MSIE)

As credit union website developers, one of the banes of our existence is the browser Microsoft Internet Explorer (MSIE). This ancient, archaic, creaking pile of code is absolutely infested with quirks, bugs, and inexplicable behavior. But this isn’t simply web developers whining about weird-looking websites. The biggest problem is that MSIE is absolutely infested with…

Your marketing flow starts with your website

Your website has never been more valuable. If nothing else, the last few months have proven how important your website is to your credit union. It’s the one branch that never closes, the public face that everyone sees. The source of information and access that your members need on a daily basis. It can also…

De-Mummify your Marketing

Is your marketing groaning, moaning, and shuffling its way out to your members? Are you feeling cursed? Forever doomed to create and recreate calcified content? Don’t plague your members with soul-sucking, reanimated marketing campaigns. Here’s a few ideas on how to reinvigorate your marketing and shake off bad voodoo. Quit worshiping the past You can’t…

You want more Millennials? (Part 2)

In my last article, I shared a not-so-secret insight: Millennials are often hard to reach because we just don’t see any reason to get invested in a brand. And most brands aren’t giving us one, so we don’t care. We all know the traditional marketing approaches often don’t work for Millennials. Heck, we’ve been known…

You want more Millennials? (Part 1)

CUs would seem to be in a perfect position to attract Millennials. The foundational concept of people helping people. Banding together to create something where everyone benefits. No shareholders to satisfy, with their just-give-me-that-dividend mindset. CUs literally exist to help their members and their communities. Which is something Millennials can appreciate. So why is it…

Five reasons your website is a fright

In honor of spooky season, let’s talk about a few of the ways your credit union website might be causing horrible moaning and groaning, or even frightening members away. And, more importantly, what you can do about it. 1) It’s mummified and lifeless Does your website just sit there, creepily staring into space, with no…

AI video might be the answer to your problems

When experts demonstrate applications for artificial intelligence (AI), the potential looks amazing. But, the application has always fallen a bit short. AI’s Rough Start One of the problems with AI-created interactions in the past has been it’s lack of “human-ness.” Robotic voice synthesizers and response algorithms created rigid, machine-like experiences. Early AI wasn’t able to…

Give your members a break.

We’re all a little stressed out right now. Our friends and family are stressed. Our bosses and coworkers are stressed. Heck, even our dogs are stressed. Whether it’s being overworked, or overexposed to the news cycle and politics, a lot of us just need a breather. But, hot take, you can look at this burnout…

5 Easy Ways to Generate Email Content Ideas

Email marketing newsletters are still an effective marketing tool. But how do you keep your audience coming back for more? You’d think the process would be easier over time, but it’s actually more challenging. Each new article seems to overlap content written in the past. Below is a short list of easy wins for e-newsletter…

What’s your Mission?

I have quite a few tools from a company called iFixit. They sell parts and tools for fixing lots of things (mostly cell phones) you’re not supposed to fix. They don’t just sell teensy weird screwdrivers and spudgers, though; their mission is nothing less than “Teach the world to fix every single thing.” And part…

Sex, Brands, and Rock & Roll

Don’t you just love to see marketing that’s, you know, good? There were a couple of examples of fun, interesting, and ultimately effective marketing that we picked up on this past week. The first was a bottled-water alternative called Liquid Death. The second was a racy, definitely cheeky (excuse my dad pun), and likely NSFW…

Don’t forget to listen to your followers.

There are plenty of ways to get member feedback: take a poll, distribute surveys, and ask your call center for a list of FAQs. But the place where a lot of CUs are missing the mark, however, is social listening. Social listening is an important part of your social media strategy and integral to guiding…

FREE ICON: 100% Member Owned

Last week I saw a semi-trailer emblazoned with a company logo and the words “100% Employee Owned” underneath, and I thought it was a great way to differentiate their company from all of the others. Then I started wondering why credit unions don’t say something similar. After all, CU members are the owners of their…

Streaming ain’t radio.

If you’re running ads in audio streaming services like Pandora, Spotify, podcasts, etc., read the room. Tailor your message, offer, script, and production to the context. A commercial in a listener’s headphones while listening to a finely tuned personal playlist feels a lot more intrusive than listening to the radio. You’re in a space the listener…

You need to be social to grow Social Media

You’ve done it. You created accounts for your Credit Union on every social media platform, picked your social media management tool, and started planting some custom content. You post at the recommended times, and answer your followers’ and fans’ messages. In short, you’ve planted your social media garden. Congrats! Good job! But your engagement, the…

How your website can help members help themselves

Even though most CUs have branches that are at least partially open, many members still prefer to manage their money and get the answers they need online or by phone rather than in-person. Which is why one of the consistent side effects for the past few years has been greatly increased call volume at credit…

Five ways credit unions can put that deposit surge to work

From the national data, and what we’re hearing from our clients, credit unions have seen a deposit surge in the second quarter of 2020. Members are spending less, many are getting back to work, and everyone wants to build their emergency funds in a safe place. Driven by record low rates, mortgages and mortgage refis…

Your best social media marketing tool

Social media is based on people sharing ideas and information, creating online communities and conversations. We’ve already told you about a few of the social media management systems we’ve tested, and the importance of maintaining your presence on social media. But, to let you in on a little trade secret, you already have access to…

I went Social Media Management Speed Dating

Recently I wrote an article about how important it is to include social media in your digital strategy, but of course someone still has to make it happen. For a few of our clients that someone was me. So, I decided to “date” a few different social media management systems to see which ones might…

Right now, your digital presence is who you are.

With everything happening these days, your digital presence is either your most prominent asset or your most obviously-neglected marketing liability for the foreseeable future. People have now been stuck at home or afraid to come see you for months. Many are planning on staying home for a long time. That makes your digital presence more…

What if we turned branches inside-out?

In an earlier SharediDiz article, I just had to admit that I’ve always been a branch hater. When I need to get something done, visiting a branch has always been the absolute last resort. But maybe I was being a little harsh. A lot of people still like branches. They can make people feel more…

Ten fast video content ideas for credit unions

Everyone knows that video content is the most engaging by far on websites and social media. That goes double when branch access is restricted, and people are depending heavily on online access. Of course, credit union products and services are a little abstract, so it can be hard to figure what’s interesting and engaging. Here…

I hate branches

I’m a branch hater. There, I said it. When I need to get something done with money, visiting a credit union branch has been the absolute last resort for, well, for pretty much my whole life. Branches are time-consuming, inconvenient, and never open when I need them. How many of your members feel the same way? How many…

When opportunity pops up

Marketers with experience know that you can’t reach every demographic with a single campaign. They also know that when you have a limited budget, it’s better to focus on key target audiences in order to get the results that are needed. But sometimes a larger marketing opportunity pops up that is too good to ignore.…

Don’t merge without your members

If you have been part of the credit union world for any length of time, you know there have been a lot of mergers, even while greatly increasing membership and offering expanded benefits. And it looks like those merger trends will continue. Over the years, we’ve had the honor of helping several credit unions navigate these mergers. And we’ve…

How is a credit union supposed to respond to current events?

How is a credit union supposed to respond to current events? Now, I know that most credit union CEOs and Boards typically don't respond to current events. But these issues are not going away any time soon, and how you respond today will affect how your credit union is perceived by the members you need to stay viable in the future.