Your vague and squishy brand is hurting membership

A vague and squishy brand makes it almost impossible for a credit union to bring in new members. Without a solid reason to notice or care, no one other than your most involved members will know who you are, or what makes you different.

Yes, it probably doesn’t help that the generic tagline next to your credit union logo would probably work for the community bank or plumber on the next corner. It could be that your website is a bit creaky-looking, and if your marketing mainly focuses on dollars and percents you end up sounding like pretty much every other financial institution, blending in rather than standing out.

But all of that might not matter as much — if you give them a good enough reason to belong.

People need a reason to do anything.

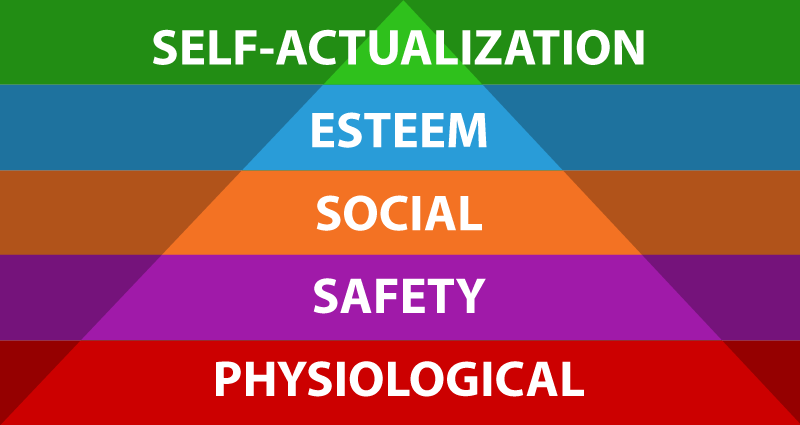

Those reasons can range from survival by fulfilling basic needs, to being accepted and valued by others, to realizing their full potential as a human. Sometimes these reasons are specific, sometimes they overlap, and, to make things even more confusing, they are usually different for each person.

Perhaps the easiest way to understand how these reasons work is by viewing Abraham Maslow’s hierarchy of needs, a pyramid with the most fundamental physiological needs (air, water, food, etc.) at the base layer, moving up layer by layer through safety (health, well-being, security), social (friendships, love, family), esteem (self-respect, confidence, recognition), all the way up to self-actualization and self-transcendence (creativity, achieving potential, altruism).

Give them a real reason to join.

Since people need a reason and we have a pyramid of reasons to look at, let’s review each level to see if we can find a fit for credit unions.

The bottom tiers are the most critical for survival, both physically and mentally. Since financial services don’t fall into the basics of air, water and food, we’ll skip the Physiological level. There is a level of Safety and security, but that isn’t unique to to only credit unions.

Some credit unions have tried to focus on the friendship aspects of the Social level, and your branch staff have likely become “near-friends” with branch regulars. But it is certainly a stretch to get members to actually think of their credit union as part of the family, much less as someone they love. Sorry.

Esteem has been the layer most targeted and manipulated by advertisers over the years, but is also where most credit unions can make a strong, authentic connection. Credit unions were created by individuals banding together as equals, pooling resources for a mutual benefit. That means respect for members, treating each one as a friend, is baked into the CU pie. Continue to amplify that, and you begin to make a case for the credit union difference.

Yet it’s that top level which can make a much bigger difference.

Change vague and squishy to purposeful.

The difference between the top level of the pyramid and all lower levels is a shift from what’s missing to what’s possible. The top is where you find aspirational goals; the desire to achieve one’s full potential, to have a purpose. And they connect deeply with your potential members.

That’s why even large corporations are starting to embrace purposeful marketing. Some are doing it much better than others of course, but when 90% of consumers are more likely to trust a company whose values align with what they care about, and millennials are connecting with brands making the world a better place, executive teams should probably pay attention.

Start by looking around you: Where are your members involved? What has the credit union supported in the past? What has the most connection to your roots? What is the most sustainable for best results? What will have the most impact?

Build a consensus across different departments by getting them involved and asking for input. Get your marketing agency‘s input and perspective. Create a long-term strategy that will build and reinforce the purpose as you progress. Ask your members for feedback and incorporate as many good ideas as possible along the way.

By aligning your credit union with a cause that potential members agree with and support, you can form a deep emotional connection that builds trust and loyalty as you share a common purpose. You become known as a force for doing good, and your reputation will grow with your membership.

- It’s hard not to get caught up in a buzz that surrounds you. - April 9, 2024

- Turn your staff into an Idea Factory. - February 27, 2024

- Move with the future or get left behind - February 6, 2024